April 15 is the federal tax deadline for individuals and small businesses in 2024. It is the due date for paying taxes you owe on income earned in 2023 and the last day to submit your tax return.. The IRS will start accepting 2022 federal income tax returns on January 23, the tax agency announced on Thursday. Of course, you don't have to file your return that early. The official due date.

Tax time! 10 most common IRS forms explained

June 2022 Newsletter Tax time targets Saywells

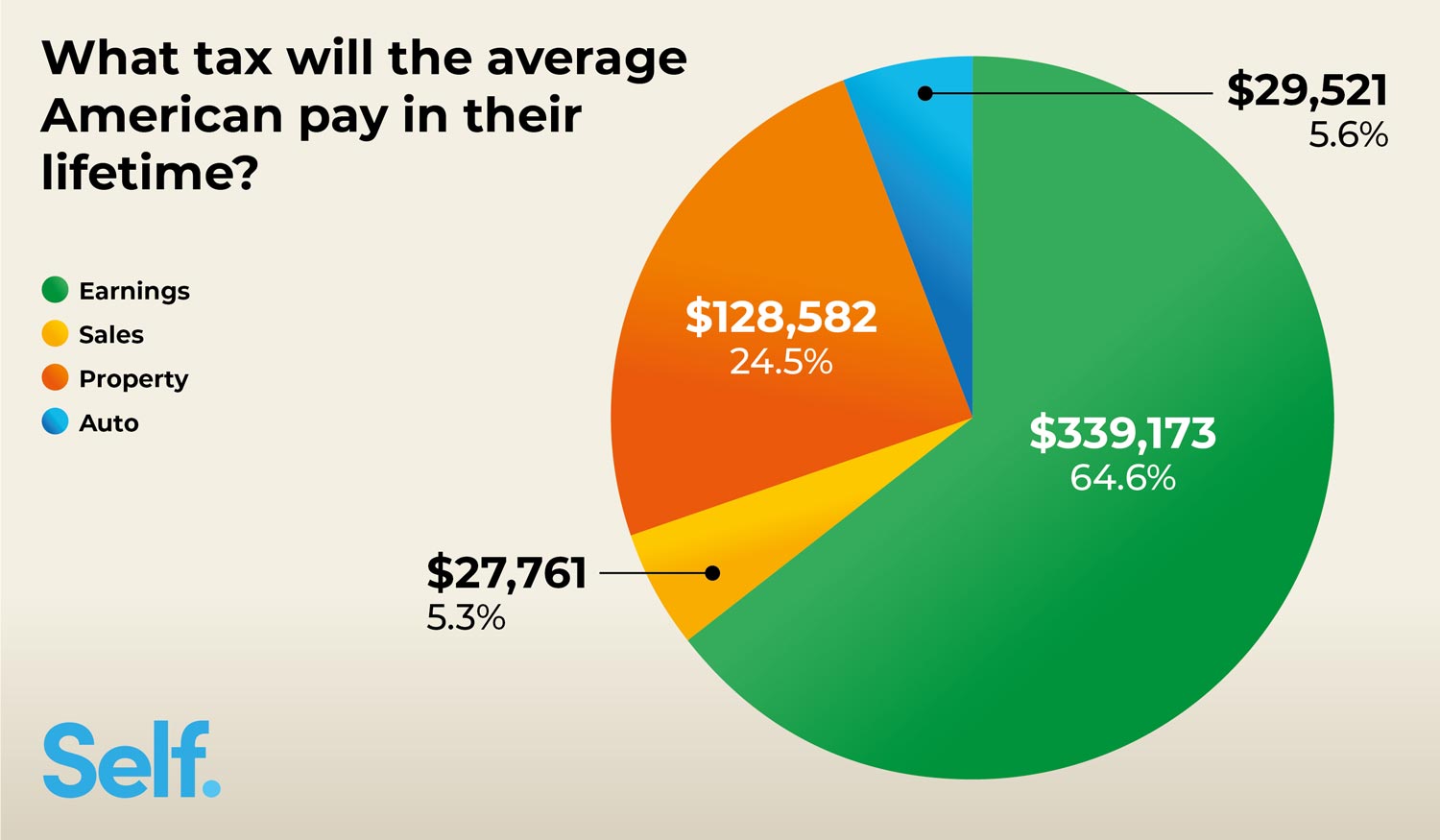

Americans Pay More Than 525,000 In Tax Over A Lifetime CPA Practice Advisor

Collection Agencies Are You Ready to Maximize Tax Season? TCN

Get ready for tax season! The IRS has confirmed the filing of tax returns to begin on January 28

Free Federal and State Tax Return Preparation for Qualifying Taxpayers Until April 15

Taxes Wallpapers Wallpaper Cave

Tax Time The Best Time To Start A Business! YouTube

It's Tax Time 2016! What you need to know about the key changes Burns Sieber

Taxes time stock illustration. Illustration of color 53214974

6 Easy Organization Tips to Take Time off of Taxes Wealthcare Partners of Santa Barbara

Tax Time Reminder!

Blog A A Tax & Accounting Services LLC

Get Ready for Taxes Here’s What's New and What to Consider When Filing in 2022 BST & Co. LLP

Paying Taxes 101 What Is an IRS Audit?

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History of Taxes in the U.S.

Crescent Tax Filing Tax Preparation Services

Tax time Stock Photo by ©lucadp 9336710

The QuickandDirty Guide to Preparing Your Business for Tax Time

It's tax time! Assistance is now available Access Press

Tax Time Guide: Things to consider when filing a 2022 tax return IR-2023-32, Feb. 22, 2023 — With the 2023 tax filing season in full swing, the IRS reminds taxpayers to gather their necessary information and visit IRS.gov for updated resources and tools to help with their 2022 tax return.. 1-3 weeks. 3 weeks. 1 month. 2 months. Based on how you file, most taxpayers can generally expect to receive a refund within these time frames. On average, filers receive their refunds two weeks after their taxes were accepted by the IRS for direct deposits and three weeks after e-filing for a paper check in the mail.